Our approach is

Transacted and Advised

Exclusive Mandates

Investor Partners

We are sector-agnostic

stage specialists

- Consumer

- Healthcare

- SaaS

- Financial Services

- Climate

- Emerging Technologies

- Hardware

- Media & Entertainment

Bonds we forged

Valence exclusively advised GoApptiv on their $15M Series A round, on fundraising, strategy and M&A, resulting in a round led by Cipla and HealthQuad.

Valence exclusively advised Co-Develop on their Digital Public Infrastructure thesis and consequently, identifying their LPs and a fiscal sponsor.

Valence advised Memesys Games on fundraising & strategy, securing seed funding from top gaming and media experts and remains a retained strategic advisor.

Enabling collective

ecosystem growth

For Founders

For Funders

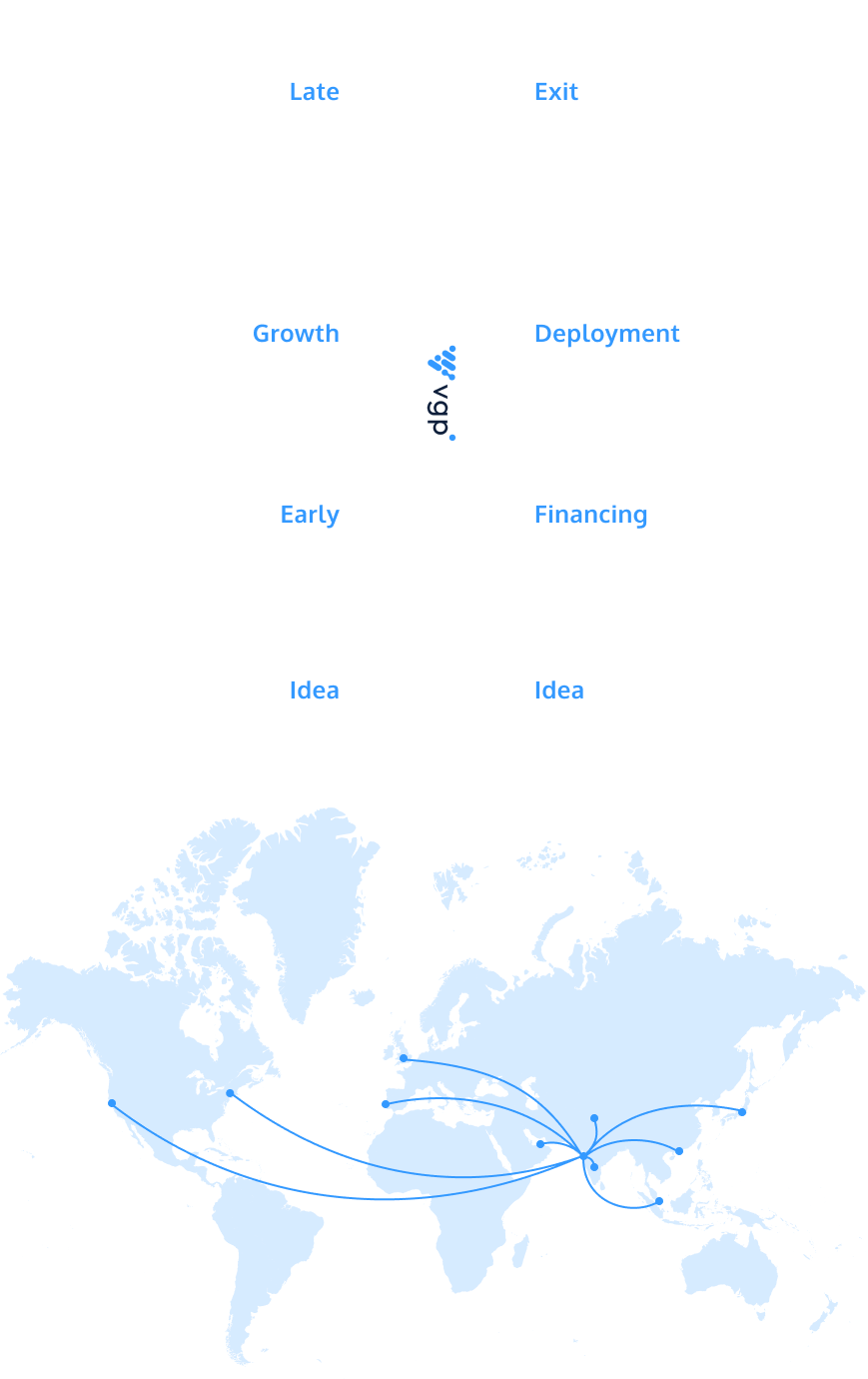

Perspective

and presence

Food & Beverage Industry Emerging Trends Report

A note from our founder Having been a food entrepreneur in the past, I am personally extremely...

Telling your story the way it was always meant to be told

Behind the origins of every world-changing startup is a story, not a product or a business model. It’s the narrative behind a founder’s journey that transforms an idea into a mission, rallying investors behind a shared vision. In today’s noisy market, where innovation is abundant and attention scarce, your story isn’t just a “nice to have”—it’s your superpower.

UK-India: Creating ‘Common’ Wealth

There’s enough proof in the pudding – with US primary markets reaching saturation, India and the UK need to leverage their collective resources, intellectual property and skilled talent pool to forge the road for the next generation of technology companies.